Key Terms and Concepts

In this section, we explain several key terms you will encounter as you explore the data. Many of these terms are also included in the Open FI$Cal metadata documentation.

Account

Each transaction has an associated seven-digit code—the Account Code—that indicates what the transaction was for. Every state transaction, not just the expenditure transactions shown on Open FI$Cal, has an associated Account Code. A complete listing of these codes is called a Chart of Accounts.

The first digit of the Account Code indicates the general type of the transaction, as shown in the following table:

| First Digit | Account Type |

|---|---|

| 1 | Asset |

| 2 | Liability |

| 3 | Equity/Fund Balance |

| 4 | Revenue |

| 5 | Expenditure |

| 6 | Transfers (Revenue & Expense) |

| 9 | Statistical |

Open FI$Cal currently contains only expenditure transactions, so all account codes on the site begin with the number ‘5’.

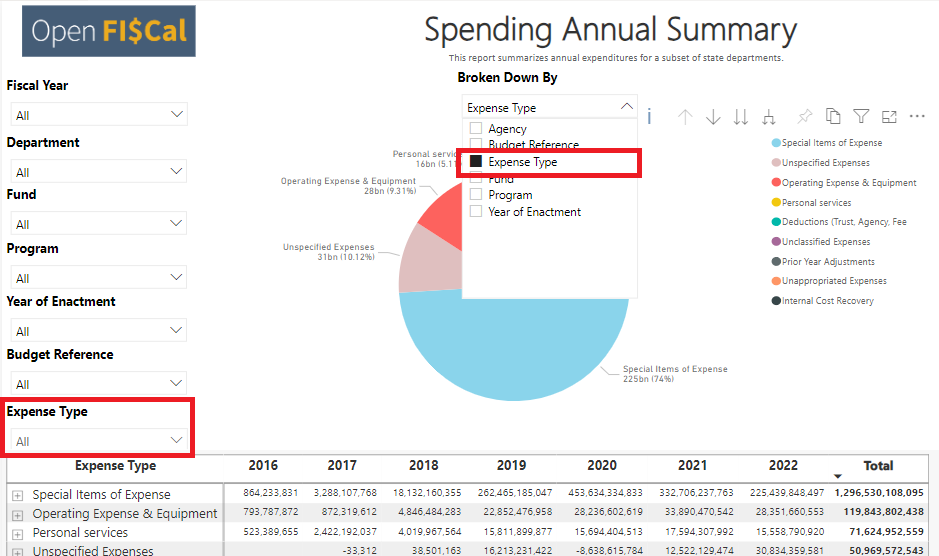

The remainder of the seven-digit code indicates more precisely what the expenditure purchased. To help you understand these codes, we have included a number of fields in the data that describe the types of expenditure from a high level to a fine level of detail. In order from most general to most specific, these are: Account Type (or Expense Type), Account Category, Account Sub-Category, and Account Description.

The table below shows several examples of account codes and their explanatory fields:

| Account Code | Account Type (Expense Type) | Account Category | Account Sub-Category | Account Description |

|---|---|---|---|---|

| 5100000 | Personal Services | Salaries & Wages | Civil Service Employees | Earnings – Permanent Civil Service Employees |

| 5304400 | Operating Expense & Equipment | Communications | Delivery Services | Delivery Services - Couriers |

| 5340580 | Operating Expense & Equipment | Consulting & Professional Services | External | Consulting & Professional Services External Other |

| 5442000 | Special Items of Expense | Other Special Items of Expense | Other Special Items of Expense | Medical & Health Care Payments |

Note that the state uses a number of different charts of accounts for different purposes. While all are quite similar, they differ in some details. The chart of accounts used on Open FI$Cal is based on one called commitment control, which departments use to compare actual expenditures against budgeted expenditures.

See also the Open FI$Cal metadata documentation.

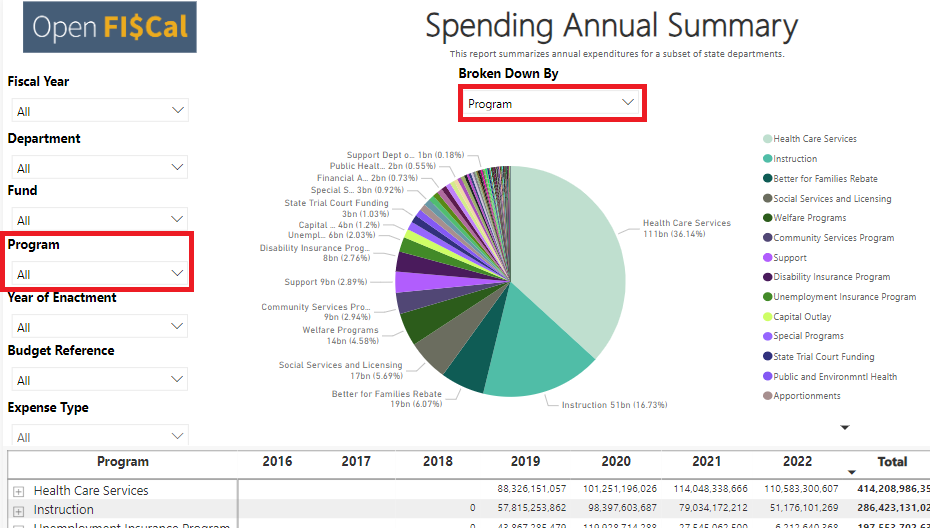

Program

Each transaction has a seven-digit Program Code associated with it. While the Account Code describes what is purchased with the expenditure, the Program Code indicates the activity the expenditure is associated with. In other words, the Program is what the state is trying to accomplish.

We include additional fields on Open FI$Cal describing the Programs and Sub-Programs associated with each of these codes. The first four digits of each Program Code indicate the Program, and the last three digits indicate the Sub-Program, if any. If there is no Subprogram associated with a Program, the last three digits will be ‘000’, and the text in the Sub-Program Description field will be the same as the text in the Program Description field.

Several examples are below:

| Program Code | Program Description | Sub-Program Description |

|---|---|---|

| 3960022 | Health Care Services | Benefits (Medical Care & Services) |

| 6770010 | State Budget | Preparation |

| 5925000 | Disability Insurance Program | Disability Insurance Program |

See also the Open FI$Cal metadata documentation.

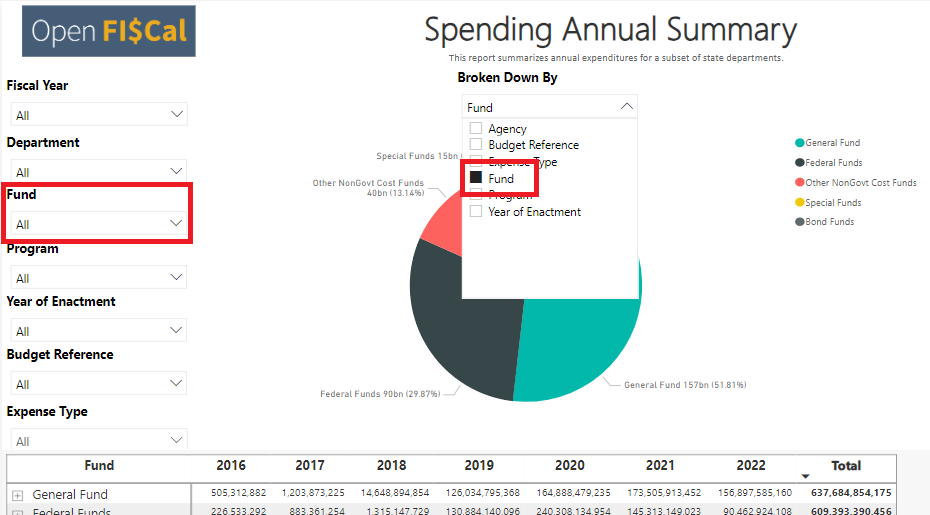

Fund

Each transaction has a four-digit Fund Code associated with it. The Fund Code describes the particular state fund used to pay for the expenditure. Funds are divided into several Fund Groups. These are:

- General Fund

- Federal Funds

- Special Funds

- Bond Funds

- Other Nongovernmental Cost Funds

Along with the four-digit Fund Code, Open FI$Cal includes a Fund Group field and a Fund Description field to describe the fund group and name of each fund.

See also the Open FI$Cal metadata documentation.

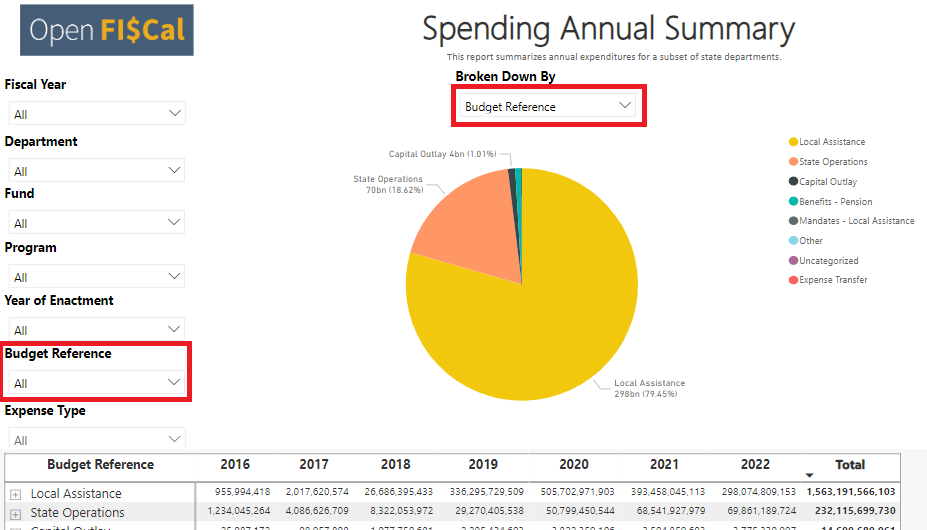

Budget Reference

Budget Reference is a three-digit code associated with each expenditure, and it encodes two pieces of information:

- The major purpose of an expenditure, which indicates which of the following categories the expenditure falls within:

- State Operations

- Local Assistance

- Mandates – Local Assistance

- Capital Outlay

- Expense Transfer

- Benefits – Pension

- Uncategorized

- Other

- Whether the expenditure is authorized in the annual Budget Act or not. While some state expenditures are authorized in the state’s annual budget, others are funded outside the budget act. These Non-Budget Act funds don’t need a new appropriation in the annual budget to authorize their expenditure. See Year of Enactment for more information.

Open FI$Cal also includes separate fields that break out the information encoded in the Budget Reference code. Budget Reference Category classifies expenditures by their major purpose, such as “State Operations” or “Local Assistance”. Budget Reference Sub-Category states whether the expenditure is “Budget Act” or “Non-Budget Act”.

See also the Open FI$Cal metadata documentation.

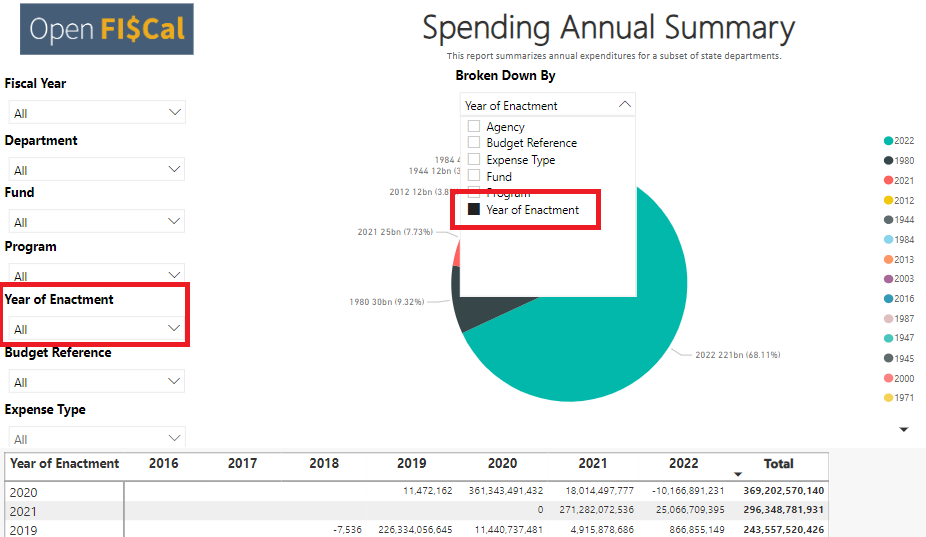

Year of Enactment

Each transaction includes a field that indicates the year in which the funding that paid for expenditure was authorized, called Year of Enactment.

For funding appropriated by the annual Budget Act (see Budget Reference for more information), Year of Enactment will usually be no more than three years prior to the Fiscal Year of the expenditure, as the annual Budget Act in most cases requires that expenditures of authorized funds happen within three years of their Budget Act appropriation.

For funding that is not appropriated by the annual Budget Act, the Year of Enactment is the year the continuous appropriation was first authorized, which in some cases can be decades before the Fiscal Year of the expenditure.

See also the Open FI$Cal metadata documentation.

Clearing Account

A number of transactions on Open FI$Cal are assigned to Program 9999000, the “Clearing Account.” This “account” is neither a separate source of funds nor a categorization of what is purchased. As such, it can be the source of some confusion.

When a department assigns an expenditure to the “Clearing Account” program, it simply means that the final categorization of that expenditure has not yet occurred. The department will later assign that expenditure to all the correct categories, including to the correct program. That reassignment should happen within the same fiscal period, which generally means the same month. Therefore all of a department’s Clearing Account expenditures should usually total $0 in a given month once all corrections and adjustments are made.

One common example of Clearing Account usage is for departments’ payroll expenditures. Paychecks are issued to employees at the end of each month, before all the information from the employees’ timesheets is available. Later, when the department has calculated how many hours employees spent on each activity, it adjusts the transactions to assign them to the correct program, fund, etc.

Negative Expenditures

A review of the detailed transactions on Open FI$Cal will reveal many negative expenditure amounts. Negative expenditures can happen for a number of reasons.

Negative expenditures often occur when expenditures must be adjusted in some way after they are posted in FI$Cal. For example, a department may make a purchase with a specific funding source, but determine afterward that it should have used a different funding source. When it does decide the appropriate funding source, it will reverse the transaction—causing a negative expenditure — and re-enter the transaction with the correct funding source.

Seeing just the initial transaction or the final adjusted transaction would be simpler to understand, but each on its own leaves out information. In order to provide complete information, Open FI$Cal includes all expense transactions, positive and negative.

There are a number of other reasons for negative expenditures, which can vary from department to department. You may see these described in the data as “Special Adjustments,” “Prior Year Adjustments,” “Internal Cost Recovery” and “Expense Transfers,” among others. Contact the department that made the expenditure for an explanation of that department’s situation.

SCO Inbound Interface

One account code commonly seen in Open FI$Cal that can cause confusion is 5390950, “SCO Inbound Interface Departm”. This account code results from the fact that some of the state’s transactions are first handled by the State Controller’s Office (SCO) outside the FI$Cal system, and are entered into FI$Cal by SCO after the fact. Expenditure transactions that fall within this category are:

- Expedited payments that require faster than normal processing by the State Controller’s Office

- Payments that require special handling, such as a paper check that the department must hand-deliver to the recipient

- Electronic fund transfers and payments made with state purchase cards

- Transactions interfaced into the FI$Cal system from non-FI$Cal departments

Enhancements to the system are underway that will allow these types of transactions to be directly entered into the system, reducing the use of this account code.