Spending vs. Vendor Reports

Open FI$Cal contains two types of expenditure data:

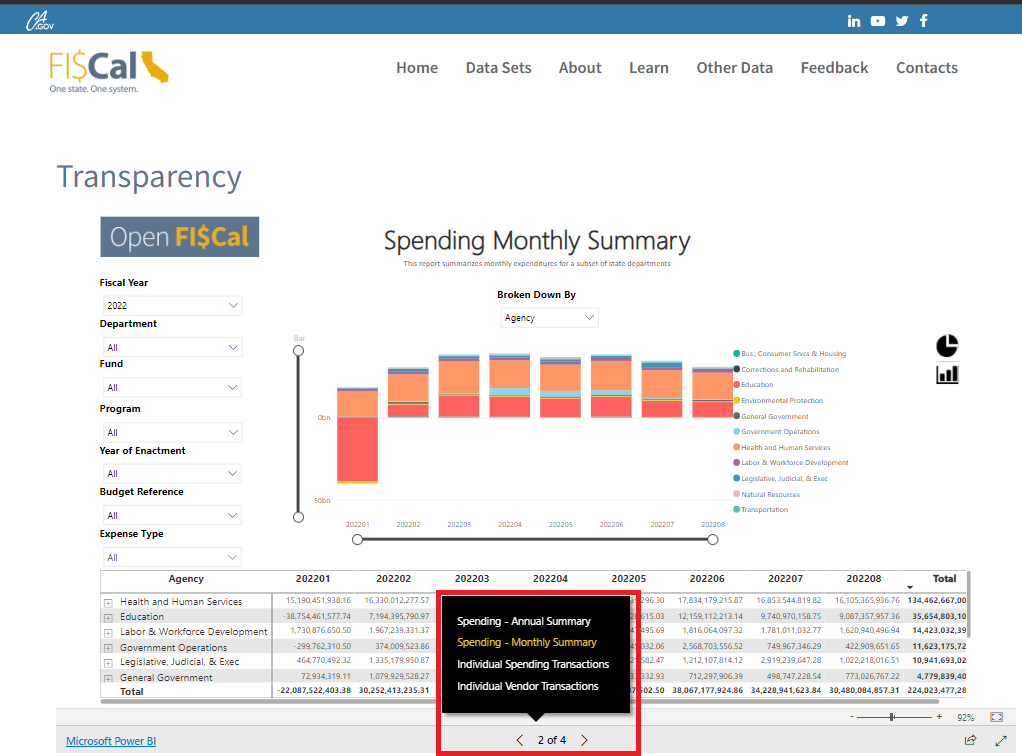

- The first dataset, visible in most reports on Open FI$Cal, is all expenditure transactions of departments that use the FI$Cal system for their accounting, taken from the modified accrual general ledger for FI$Cal departments. This dataset also includes cash basis transactions for some non-FI$Cal departments. This is the most complete set of expenditures, but it does not include the names of vendors paid.

- The second dataset, visible in the “Vendor Transactions” report on Open FI$Cal, is the subset of expenditure transactions that flow through FI$Cal’s Accounts Payable module. This does not include every state expenditure transaction, but it does include the names of vendors paid.

Which transactions are not included in the “Vendor Transactions” dataset?

The Vendor Transactions dataset does not include transactions that do not flow through FI$Cal’s Accounts Payable module. Examples of excluded transactions include:

- Bulk payments to large numbers of recipients, including state employee payroll and social service grants

- Expedited payments that require faster than normal processing by the State Controller’s Office

- Payments that require special handling, such as a paper check that the department must hand-deliver to the recipient

- Electronic fund transfers and payments made with state purchase cards

- Transactions interfaced into the FI$Cal system from non-FI$Cal departments

Enhancements to the system are underway that will begin capturing vendor information for some of these types of payments in the future.